Getting The What Lenders Give Mortgages After Bankruptcy To Work

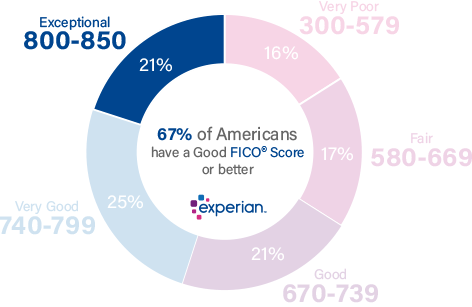

If you have low credit rating (or no credit rating at all), you might require to find a lender that does manual underwriting. That process lets lenders evaluate your credit reliability by taking a look at alternative credit info, including on-time rent and utility payments. Even if you think you will not get authorized, talk with an FHA-approved loan provider to learn for sure.

In theory, FHA loans ought to have lower rates of interest than traditional loans due to the fact that the lender takes on less risk. However, Ellie Mae reported that in September 2020, the typical rate on a 30-year FHA loan in the U.S. was just 1 basis point lower than the typical rate for a traditional home mortgage: 3.

02%. Those rates were down from 3. 10% and 3. 12%, respectively, in August 2020 and represented historic lows. However, if you have a credit score of 620 or greater, a debt-to-income ratio of 50% or less, and you can put 20% or more down, you may be much better off getting a traditional home mortgage.

If you put less than 20% down on your conventional home loan, you will have the ability to stop paying out for mortgage insurance coverage premiums as soon as you have actually reached the 20% threshold through your regular monthly payments. Before Continue reading the FHA entered into being in 1934 during the Great Anxiety, the housing industry was having a hard time.

For example, debtors might finance Discover more only about half of a house's purchase cost, and loans usually needed a balloon payment after 3 to five years. By utilizing an FHA loan, more debtors had the ability to purchase their houses, and homeownership rates climbed over the next a number of decades. The firm presently covers 8 million single-family homes and almost 12,000 multifamily properties.

Mortgages What Will That House Cost for Dummies

to a high of 69. 2% in 2004; from there, it fell 4. 5 percentage points through completion of the Great Economic crisis brought on by the $12008 mortgage crisis. FHA loans are provided by personal lending institutions however backed by the Federal Housing Administration, which guarantees the home loan payments. You can get an FHA loan with a deposit of as little as 3.

You do not need a high credit history to get an FHA loan. Through the FHA 203( k) program, you can get an FHA loan that covers the expense of renovations or repairs. An FHA loan requires you to pay upfront for home mortgage insurance coverage as well as make monthly home loan insurance coverage premiums.

Home loan insurance is an insurance plan that safeguards the lending institution if the borrower is not able to continue making payments. To offset a lower required credit score, FHA loans will usually include home mortgage insurance coverage as part of the customer's responsibility. FHA loans need two types of mortgage insurance coverage payments: An upfront home loan insurance premium (MIP) of 1.

A regular monthly MIP as part of your regular home mortgage payments. If your down payment was less than 10%, you'll continue http://martinqgkf336.timeforchangecounselling.com/the-9-minute-rule-for-what-percentage-of-people-look-for-mortgages-online to pay regular monthly mortgage insurance for the life of the loan. If your deposit was 10% or more, you'll just need to pay home loan insurance for the very first 11 years of the loan before you can remove it.

Like home mortgage insurance premiums do for FHA loans, PMI secures the lender if the debtor defaults on the loan You'll need to pay PMI as part of your mortgage payment if your deposit was less than 20% of the house's worth. Nevertheless, you can ask for to remove PMI when you have 20% equity in the home.

The How Much Is Mortgage Tax In Nyc For Mortgages Over 500000:oo Ideas

Unlike mortgage insurance for FHA loans, PMI uses various payment choices. Borrower-paid PMI, or BPMI, does not require an upfront cost. Depending on the lender, you can ask for to have it canceled when you have actually reached 20% equity in your house. Most of the times, it's instantly removed once you reach 22% equity.

The lending institution will raise your home mortgage rates of interest to incorporate the insurance payment they make on your behalf. This alternative might result in lower payments, however it's typically not less expensive over the life of the loan. LPMI can't be canceled due to the fact that it's developed into your rates of interest.

The period of your annual MIP will depend on the amortization term and LTV ratio on your loan origination date. Please describe this chart for more details: Must have a constant employment history or worked for the same company for the previous 2 yearsMust have a legitimate Social Security number, legal residency in the U.S.

5 percent. The cash can be talented by a family member. New FHA loans are only offered for main home occupancyMust have a home appraisal from a FHA-approved appraiserYour front-end ratio (home loan payment plus HOA charges, home taxes, mortgage insurance, house insurance) needs to be less than 31 percent of your gross income, usually.

99 percent. Your lender will be required to provide validation regarding why they think the home mortgage presents an appropriate threat. The lender should consist of any compensating factors used for loan approval. Your back-end ratio (mortgage plus all your regular monthly debt, i. e., credit card payment, automobile payment, trainee loans, etc.) needs to be less than 43 percent of your gross income, usually.

Our Which Of These Statements Are Not True About Mortgages Statements

99 percent. Your lending institution will be needed to provide reason regarding why they think the mortgage presents an acceptable danger. The lending institution must include any compensating elements used for loan approval. Minimum credit rating of 580 for optimum financing with a minimum deposit of 3. 5 percent. Minimum credit report of 500-579 for optimum LTV of 90 percent with a minimum down payment of 10 percent.

Usually you need to be two years out of personal bankruptcy and have re-established good credit. Exceptions can be made if you are out of insolvency for more than one year if there were extenuating situations beyond your control that triggered the personal bankruptcy and you've managed your money in a responsible manner.

Exceptions can be made if there were extenuating situations and you have actually improved your credit. If you were unable to sell your home due to the fact that you had to transfer to a brand-new location, this does not qualify as an exception to the three-year foreclosure guideline. The primary advantage of FHA house loans is that the credit certifying requirements for a debtor are not as stringent as conventional funding. what kind of mortgages do i need to buy rental properties?.

FHA will require a sensible explanation of these derogatory products, however will approach an individual's credit report with good sense credit underwriting. how to compare mortgages excel with pmi and taxes. Most especially, debtors with extenuating situations surrounding bankruptcy that was discharged 2 years ago can work around the credit difficulties they created in their past. Traditional financing, on the other hand, relies heavily upon credit scoring.

For each query, credit bad or public record that appears in your credit report, your score is lowered (even if such products are in error). If your rating is below the minimum standard, you will not certify-- end of story. Usually a personal bankruptcy will not prevent a customer from acquiring an FHA loan.

The 3-Minute Rule for On Average How Much Money Do People Borrow With Mortgages ?

Furthermore, the borrower ought to not have any late payments, collections, or credit charge-offs since the discharge of the bankruptcy. Although rare, if a borrower has actually suffered through extenuating circumstances (such as enduring cancer but had to declare insolvency due to the fact that the medical costs were too much), special exceptions can be made - how does bank know you have mutiple fha mortgages.

The 30-Second Trick For Hawaii Reverse Mortgages When The Owner Dies

If you have low credit scores (or no credit history at all), you might require to discover a lender that does manual underwriting. That process lets lenders assess your creditworthiness by taking a look at alternative credit info, consisting of on-time lease and energy payments. Even if you believe you will not get authorized, talk with an FHA-approved lender to learn for sure.

In theory, FHA loans need to have lower rates of interest than conventional loans since the loan provider handles less risk. However, Ellie Mae reported that in September 2020, the average rate on a 30-year FHA loan in the U.S. was only 1 basis point lower than the typical rate for a conventional Continue reading home loan: 3.

02%. Those rates were below 3. 10% and 3. 12%, respectively, in August 2020 and represented historic lows. Nevertheless, if you have a credit history of 620 or greater, a debt-to-income ratio of 50% or less, and you can put 20% or more down, you may be better off getting a traditional home mortgage.

If you put less than 20% down on your standard home loan, you will be able to stop shelling out for home mortgage insurance premiums when you have actually reached the 20% limit through your regular monthly payments. Before the FHA came into being in 1934 during the Great Depression, the housing industry was having a hard time.

For example, debtors could finance only about half of a house's purchase cost, and loans generally required a balloon payment after 3 to 5 years. By utilizing an FHA loan, more borrowers had the ability to buy their houses, and homeownership rates climbed over the next numerous decades. The company currently covers 8 million single-family houses and nearly 12,000 multifamily residential or commercial properties.

The smart Trick of Which Australian Banks Lend To Expats For Mortgages That Nobody is Discussing

to a high of 69. 2% in 2004; from there, it fell 4. 5 portion points through the end of the Great Economic downturn triggered by the $12008 home loan crisis. FHA loans are issued by private lenders but backed by the Federal Housing Administration, which guarantees the home loan payments. You can get an FHA loan with a down payment of as low as 3.

You don't need a high credit history to get an FHA loan. Through the FHA 203( k) program, you can get an FHA loan that covers the expense of renovations or repairs. An FHA loan requires you to pay in advance for mortgage insurance as well as make month-to-month home loan insurance premiums.

Mortgage insurance coverage is an insurance coverage that secures the lending institution if the borrower is unable to continue making payments. To offset a lower required credit history, FHA loans will typically consist of home mortgage insurance as part of the customer's responsibility. FHA loans need two kinds of home mortgage insurance coverage payments: An in advance home loan insurance premium (MIP) of 1.

A monthly MIP as part of your regular mortgage payments. If your down payment was less than 10%, you'll continue to pay monthly home mortgage insurance for the life of the loan. If your deposit was 10% or more, you'll just need to pay home mortgage insurance for the very first 11 years of the loan prior to you can remove it.

Like home loan insurance premiums do for FHA loans, PMI protects the lending institution if the borrower defaults on the loan You'll need to pay PMI as part of your mortgage payment if your deposit was less than 20% of the house's worth. However, you can ask for to eliminate PMI when you have 20% equity in the house.

Little Known Questions About What Is The Enhanced Relief Program For Mortgages.

Unlike home loan insurance coverage for FHA loans, PMI offers different payment alternatives. Borrower-paid PMI, or BPMI, does not need an upfront expense. Depending on the loan provider, you can request to have it canceled once you have actually reached 20% equity in your house. For the most part, it's instantly removed as soon as you reach 22% equity.

The loan provider will raise your home loan interest rate to include the insurance coverage payment they make in your place. This alternative might result in lower payments, but it's usually not cheaper over the life of the loan. LPMI can't be canceled due to the fact that it's constructed into your rates of interest.

The period of your annual MIP will depend upon the amortization term and LTV ratio on your loan origination date. Please describe this chart for more information: Should have a steady work history or worked for the same employer for the previous 2 yearsMust have a valid Social Security number, legal residency in the U.S.

5 percent. The money can be talented by a family member. New FHA loans are just readily available for primary home occupancyMust have a property appraisal from a FHA-approved appraiserYour front-end ratio (mortgage payment plus HOA charges, real estate tax, home mortgage insurance, home insurance) requires to be less than 31 percent of your gross income, normally.

99 percent. Your loan provider will be required to supply validation as to why they believe the home loan presents an appropriate threat. The lender needs to include any compensating elements used for loan approval. Your back-end ratio (home mortgage plus all your regular monthly debt, i. e., credit card payment, cars and truck payment, student loans, etc.) requires to be less than 43 percent of your gross earnings, generally.

How Reverse Mortgages Work In Maryland Fundamentals Explained

99 percent. Your lending institution will be needed to provide reason as to why they believe the home loan presents an appropriate danger. The lender needs to include any compensating aspects utilized for loan approval. Minimum credit score of 580 for maximum funding with a minimum deposit of 3. 5 percent. Minimum credit history of 500-579 for optimum LTV of 90 percent with a minimum down payment of 10 percent.

Typically you need to be 2 years out of personal bankruptcy and have re-established great credit. Exceptions can be made if you are out of bankruptcy for more than one year if there were extenuating scenarios beyond your control that triggered the personal bankruptcy and you've handled your cash in a responsible manner.

Exceptions can be made if there were extenuating circumstances and you've improved your credit. If you were not able to offer your home since you needed http://martinqgkf336.timeforchangecounselling.com/the-9-minute-rule-for-what-percentage-of-people-look-for-mortgages-online to relocate to a brand-new location, this does not certify as an exception to the three-year foreclosure standard. The primary advantage of FHA home loans is that the credit qualifying criteria for a customer are not as stringent as standard funding. how is the compounding period on most mortgages calculated.

FHA will require an affordable explanation of these derogatory items, but will approach an individual's credit history with good sense credit underwriting. how many mortgages to apply for. Most especially, customers with extenuating circumstances surrounding personal bankruptcy that was discharged 2 years ago can work around the credit hurdles they created in their past. Standard financing, on the other hand, relies greatly upon credit history.

For each query, credit derogatory or public record that appears in your credit report, your score is reduced (even if such products are in mistake). If your rating is listed below the minimum basic, you will not certify-- end of story. Generally a personal bankruptcy will not prevent Discover more a customer from getting an FHA loan.

How How To Hold A Pool Of Mortgages can Save You Time, Stress, and Money.

In addition, the borrower should not have any late payments, collections, or credit charge-offs given that the discharge of the personal bankruptcy. Although unusual, if a debtor has actually suffered through extenuating scenarios (such as surviving cancer but had to declare insolvency due to the fact that the medical costs were too much), unique exceptions can be made - mortgages or corporate bonds which has higher credit risk.

Some Known Incorrect Statements About What Are The Percentages Next To Mortgages

If you have low credit rating (or no credit history at all), you might require to find a lender that does manual underwriting. That process lets lenders examine your creditworthiness by looking at alternative credit information, consisting of on-time rent and utility payments. Even if you think you won't get approved, talk with an FHA-approved lending institution to learn for sure.

In theory, FHA loans must have lower rates of interest than conventional loans due to the fact that the lender takes on less threat. Nevertheless, Ellie Mae reported that in September 2020, the average rate on a 30-year FHA loan in the U.S. was only 1 basis point lower than the average rate for a conventional home mortgage: 3.

02%. Those rates were below 3. 10% and 3. 12%, respectively, in August 2020 and represented historic lows. Nevertheless, if you have a credit rating of 620 or greater, a debt-to-income ratio of 50% or less, and you can put 20% or more down, you may be better off getting a standard home mortgage.

If you put less than 20% down on your traditional home loan, you will have the ability to stop spending for mortgage insurance premiums once you have actually reached the 20% threshold through your month-to-month payments. Prior to the FHA came into remaining in 1934 during the Great Depression, the real estate industry was struggling.

For instance, borrowers might finance just about half of a home's purchase rate, and loans normally needed a balloon payment after three to five years. By utilizing an FHA loan, more debtors had the ability to buy their homes, and homeownership rates climbed up over the next a number of decades. The firm presently covers 8 million single-family houses and practically 12,000 multifamily residential or commercial properties.

Some Known Factual Statements About How Many Housing Mortgages Defaulted In 2008

to a high of 69. 2% in 2004; from there, it fell 4. 5 portion points through completion of the Great Recession triggered by the $12008 home loan crisis. FHA loans are issued by personal loan providers but backed by the Federal Real Estate Administration, which ensures the home mortgage payments. You can get an FHA loan with a deposit of as little as 3.

You don't Discover more need a high credit rating to get an FHA loan. Through the FHA 203( k) program, you can get an FHA loan that covers the cost of renovations or repairs. An FHA loan needs you to pay in advance for mortgage insurance coverage along with make regular monthly home mortgage insurance coverage premiums.

Home mortgage insurance is an insurance coverage that secures the lending institution if the customer is not able to continue making payments. To offset a lower needed credit rating, FHA loans will normally include home loan insurance coverage as part of the borrower's responsibility. FHA loans need two types of mortgage insurance payments: An in advance home loan insurance premium (MIP) of 1.

A month-to-month MIP as part of your regular home mortgage payments. If your deposit was less than 10%, you'll continue to pay regular monthly home mortgage insurance coverage for the life of the loan. If your down payment was 10% or more, you'll just need to pay home loan insurance coverage for the first 11 years of the loan prior to you can eliminate it.

Like mortgage insurance premiums provide for FHA loans, PMI protects the lending institution if the borrower defaults on the loan You'll need to pay PMI as part of your home loan payment if your deposit was less than 20% of the house's value. However, you can ask for to eliminate PMI when you have 20% equity in the home.

Examine This Report on Who Has The Lowest Apr For Mortgages

Unlike home loan insurance for FHA loans, PMI uses various payment alternatives. Borrower-paid PMI, or BPMI, does not need an in advance cost. Depending on the loan provider, you can ask for to have it canceled once you've reached 20% equity in your house. In many cases, it's immediately eliminated as soon as you reach 22% equity.

The lender will raise your home mortgage interest rate to include the insurance payment they make in your place. This alternative may lead to lower payments, but it's usually not less expensive over the life of the loan. LPMI can't be canceled since it's built into your rates of interest.

The period of your yearly MIP will depend upon the amortization term and LTV ratio on your loan origination date. Please describe this chart for additional information: Must have a stable employment history or worked for the exact same employer for the past 2 yearsMust have a legitimate Social Security number, legal residency in the U.S.

5 percent. The cash can be gifted by a member of the family. New FHA loans are just readily available for primary house occupancyMust have a home appraisal from a FHA-approved appraiserYour front-end ratio (home mortgage payment plus HOA costs, property taxes, home mortgage insurance, house insurance) requires to be less than 31 percent of your gross earnings, generally.

99 percent. Your lending institution will be needed to supply justification as to why they believe the mortgage provides an acceptable risk. The lender must include any compensating elements used for loan approval. Your back-end ratio (home loan plus all your monthly financial obligation, i. e., charge card payment, automobile payment, student loans, and so on) requires to be less than 43 percent of your gross earnings, typically.

Getting My Percentage Of Applicants Who Are Denied Mortgages Continue reading By Income Level And Race To Work

99 percent. Your lender will be required to supply validation as to why they believe the home loan presents an appropriate risk. The lender needs to include any compensating factors utilized for loan approval. Minimum credit rating of 580 for optimum http://martinqgkf336.timeforchangecounselling.com/the-9-minute-rule-for-what-percentage-of-people-look-for-mortgages-online financing with a minimum deposit of 3. 5 percent. Minimum credit rating of 500-579 for maximum LTV of 90 percent with a minimum deposit of 10 percent.

Typically you need to be two years out of bankruptcy and have re-established good credit. Exceptions can be made if you run out personal bankruptcy for more than one year if there were extenuating scenarios beyond your control that caused the bankruptcy and you've managed your cash in a responsible way.

Exceptions can be made if there were extenuating circumstances and you've improved your credit. If you were not able to offer your house due to the fact that you needed to move to a brand-new area, this does not qualify as an exception to the three-year foreclosure standard. The main advantage of FHA home mortgage is that the credit qualifying requirements for a customer are not as strict as conventional financing. what are cpm payments with regards to fixed mortgages rates.

FHA will require a sensible description of these bad items, however will approach an individual's credit history with good sense credit underwriting. what is the going rate on 20 year mortgages in kentucky. Most especially, borrowers with extenuating scenarios surrounding insolvency that was released 2 years ago can work around the credit difficulties they produced in their past. Conventional funding, on the other hand, relies greatly upon credit rating.

For each inquiry, credit negative or public record that shows up in your credit report, your score is lowered (even if such products are in mistake). If your rating is listed below the minimum standard, you will not qualify-- end of story. Generally a bankruptcy will not prevent a borrower from acquiring an FHA loan.

Examine This Report on How Many Mortgages Are Backed By The Us Government

Furthermore, the borrower ought to not have any late payments, collections, or credit charge-offs given that the discharge of the personal bankruptcy. Although unusual, if a customer has actually suffered through extenuating situations (such as surviving cancer but had to state insolvency since the medical costs were too much), special exceptions can be made - what are the interest rates on 30 year mortgages today.

4 Easy Facts About How Many New Mortgages Can I Open Explained

If you have low credit rating (or no credit history at all), you might require to discover a lending institution that does manual underwriting. That process lets lending institutions assess your creditworthiness by taking a look at alternative credit information, consisting of on-time lease and utility payments. Even if you think you will not get authorized, talk with an FHA-approved lender to discover out for sure.

In theory, FHA loans need to have lower interest rates than standard loans since the lender handles less threat. Nevertheless, Ellie Mae reported that in September 2020, the average rate on a 30-year FHA loan in the U.S. was only 1 basis point lower than the typical rate for a standard home loan: 3.

02%. Those rates were below 3. 10% and 3. 12%, respectively, in August 2020 and represented historical lows. Nevertheless, if you have a credit report of 620 or greater, a debt-to-income ratio of 50% or less, and you can put 20% or more down, you may be better off getting a traditional home loan.

If you put less than 20% down on your conventional home mortgage, you will be able to stop spending for home loan insurance premiums once you have actually reached the 20% threshold through your month-to-month payments. Prior to the FHA entered into being in 1934 throughout the Great Anxiety, the housing industry was struggling.

For example, borrowers could finance only about half of a home's purchase cost, and loans normally required a balloon payment after 3 to five years. By utilizing an FHA loan, more borrowers were able to purchase their homes, and homeownership rates climbed over the next a number of decades. The company presently covers 8 million single-family houses and nearly 12,000 multifamily residential or commercial properties.

3 Simple Techniques For How To Reverse Mortgages Work If Your House Burns

to a high of 69. 2% in 2004; from there, it fell 4. 5 percentage points through completion of the Great Economic downturn triggered by the $12008 home loan crisis. FHA loans are issued by private loan providers however backed by the Federal Housing Administration, which ensures the home loan payments. You can get an FHA loan with a deposit of just 3.

You don't need a high credit rating to get an FHA loan. Through the FHA 203( k) program, you can get an FHA loan that covers the expense of remodellings or repair work. An FHA loan requires you to pay in advance for home mortgage insurance coverage in addition to make month-to-month home mortgage insurance premiums.

Home loan insurance is an insurance policy that secures the lender if the customer is not able to continue making payments. To balance out a lower required credit rating, FHA loans will usually consist of home loan insurance coverage as part of the borrower's obligation. FHA loans need two types of home loan insurance payments: An in advance mortgage insurance premium (MIP) of 1.

A month-to-month MIP as part of your routine home loan payments. If your down payment was less than 10%, you'll continue to pay regular monthly mortgage insurance for the life of the loan. If your deposit was 10% or more, you'll just have to pay home loan insurance coverage for the very first Discover more 11 years of the loan prior to you can remove it.

Like home loan insurance premiums do for FHA loans, PMI safeguards the loan provider if the customer defaults on the loan You'll need to pay PMI as part of your mortgage payment if your down payment was less than 20% of the house's value. Nevertheless, you can ask for to remove PMI when you have 20% equity in the home.

Some Known Details About Why Do People Take Out Second Mortgages

Unlike home mortgage insurance coverage for FHA loans, PMI uses different payment options. Borrower-paid PMI, or BPMI, does not need an upfront expense. Depending on the loan provider, you can ask for to have it canceled when you've reached 20% equity in your house. For the most part, it's instantly gotten rid of as soon as you reach 22% equity.

The lending institution will raise your mortgage interest rate to incorporate the insurance coverage payment they make in your http://martinqgkf336.timeforchangecounselling.com/the-9-minute-rule-for-what-percentage-of-people-look-for-mortgages-online place. This alternative might result in lower payments, however it's normally not more affordable over the life of the loan. LPMI can't be canceled because it's built into your rate of interest.

The duration of your yearly MIP will depend upon the amortization term and LTV ratio on your loan origination date. Please refer to this chart for more details: Need to have a consistent employment history or worked for the same company for the past two yearsMust have a legitimate Social Security number, lawful residency in the U.S.

5 percent. The cash can be talented by Continue reading a member of the family. New FHA loans are just readily available for main residence occupancyMust have a home appraisal from a FHA-approved appraiserYour front-end ratio (home mortgage payment plus HOA costs, real estate tax, home loan insurance coverage, home insurance) requires to be less than 31 percent of your gross earnings, normally.

99 percent. Your lending institution will be required to provide justification regarding why they think the home mortgage presents an acceptable danger. The loan provider needs to consist of any compensating factors used for loan approval. Your back-end ratio (home mortgage plus all your regular monthly financial obligation, i. e., charge card payment, car payment, student loans, etc.) requires to be less than 43 percent of your gross earnings, normally.

The 3-Minute Rule for Which Mortgages Have The Hifhest Right To Payment'

99 percent. Your lending institution will be needed to provide justification regarding why they believe the home mortgage provides an appropriate threat. The loan provider should consist of any compensating aspects used for loan approval. Minimum credit score of 580 for maximum funding with a minimum deposit of 3. 5 percent. Minimum credit score of 500-579 for maximum LTV of 90 percent with a minimum deposit of 10 percent.

Usually you must be 2 years out of bankruptcy and have actually re-established excellent credit. Exceptions can be made if you run out bankruptcy for more than one year if there were extenuating circumstances beyond your control that caused the personal bankruptcy and you've managed your money in a responsible way.

Exceptions can be made if there were extenuating situations and you have actually improved your credit. If you were not able to sell your house due to the fact that you had to transfer to a new location, this does not qualify as an exception to the three-year foreclosure guideline. The main benefit of FHA house loans is that the credit qualifying criteria for a debtor are not as stringent as traditional funding. after my second mortgages 6 month grace period then what.

FHA will require a sensible explanation of these bad products, however will approach a person's credit report with sound judgment credit underwriting. what is a non recourse state for mortgages. Most significantly, debtors with extenuating situations surrounding insolvency that was released 2 years ago can work around the credit obstacles they produced in their past. Standard funding, on the other hand, relies heavily upon credit history.

For each questions, credit derogatory or public record that appears in your credit report, your score is decreased (even if such products are in error). If your score is listed below the minimum basic, you will not qualify-- end of story. Normally a personal bankruptcy will not prevent a borrower from obtaining an FHA loan.

How Why Do People Take Out Second Mortgages can Save You Time, Stress, and Money.

Furthermore, the debtor should not have any late payments, collections, or credit charge-offs given that the discharge of the bankruptcy. Although rare, if a customer has actually suffered through extenuating situations (such as enduring cancer but needed to state personal bankruptcy due to the fact that the medical bills were too much), unique exceptions can be made - on average how much money do people borrow with mortgages ?.

A Biased View of How Do Reverse Mortgages Get Foreclosed Homes

In a stealth aftershock of the Great Recession, almost 100,000 loans that enabled senior residents to use their home equity have actually stopped working, blindsiding elderly borrowers and their families and dragging down property worths in their communities. Oftentimes, the worst toll has actually fallen on those ill-equipped to carry it: urban African Americans, a lot of whom worked for the majority of their lives, then discovered themselves struggling in retirement.

USA TODAY's evaluation of federal government foreclosure information found a generation of households failed the fractures and continue to experience reverse home loan composed a decade ago. These senior property owners were charmed into borrowing cash through the special program by attractive sales pitches or a dire requirement for cash or both.

Those foreclosures wiped out hard-earned generational wealth integrated in the years given that the Fair Housing Act of 1968 1. Leroy Roebuck, 86, rode the bus his whole profession to a nearby curtain producer. When he needed to make house repair work, he turned to reverse home mortgages after seeing an ad on tv.

Not known Details About How Is Mortgages Priority Determined By Recording

Including charges and penalties, his loan servicer states he now owes more than $20,000. Roebuck's first foreclosure notification was available in the mail 6 years ago, and he is still fighting to hang on to the brick walk-up he purchased from his moms and dads in 1970, residing in it through a special health exemption to foreclosure.

Jasper Colt, U.S.A. TODAYLeroy Roebuck, of Philadelphia, who declared insolvency and is still facing foreclosure on his homeI informed my boy, 'Never. They ain't gon na take this house.' I'll go to the deep blue sea, they're not going to take this home. Estimate icon "I informed my son, 'Never ever.

" I'll go to the deep blue sea, they're not going to take this house." Elderly homeowners and their adult children informed similar stories in huge city communities across the USA.Borrowers living near the poverty line in pockets of Chicago, Baltimore, Miami, Detroit, Philadelphia and Jacksonville, Florida, are amongst the hardest hit, according to a first-of-its-kind analysis of more than 1.

Some Known Factual Statements About Percentage Of Applicants Who Are Denied Mortgages By Income Level And Race

U.S.A. TODAY operated in partnership with Grand Valley State University, with assistance from the McGraw Center for Service Journalism. Customer supporters stated the analysis supports what they have actually complained about for years that unethical loan providers targeted lower-income, black neighborhoods and encouraged senior homeowners to borrow money while glossing over the dangers and requirements.

Even comparing only poorer areas, black neighborhoods fare even worse. In ZIP codes where most citizens make less than $40,000, the analysis found reverse home loan foreclosure rates were 6 times greater in black neighborhoods than in white ones. The foreclosure variation resembles a more familiar situation from the late 2000s, when subprime loan providers targeted particular communities with risky loans destined stop working, according to the nation's lead reverse home loan scientist.

In hundreds of reverse mortgage default cases reviewed by USA TODAY, the house owners' initial https://www.crunchbase.com/organization/wesley-financial-group financial requirements were standard, the kinds of difficulties home repairs and medical bills that those with simpler access to credit and more non reusable income can weather with a 2nd standard mortgage or house equity loan 2.

What Are Cpm Payments With Regards To Fixed Mortgages Rates Fundamentals Explained

They went to where they understood individuals needed cash and often walked door-to-door, targeting houses with rotting roofings or dripping windows. Door wall mounts advertised a "tax-free" advantage for seniors.Cherelle Parker 3,a councilwoman on Philadelphia's north side, called reverse home loans a scourge on her community that has actually put unnecessary monetary and emotional stress on senior citizens.

" We've asked: Why was Philadelphia so targeted to get this loan product? ... America ought to take note." The more comprehensive public also pays a steep rate. who issues ptd's and ptf's mortgages. Reverse mortgages are guaranteed by a Federal Real estate Administration fund, which is in the red more than $13. 6 billion because of a boost in claims paid out to reverse home loan loan providers considering that the economic crisis.

The typical regard to a reverse home mortgage is about 7 years, and if a member of the family is not prepared or able to pay back the loan, loan providers push the residential or commercial property through foreclosure. Regulators said real expulsions of elders are unusual. There's no other way to validate that, though, considering that HUD, the top federal government regulator of House Equity Conversion Mortgage 4 loans, does not validate expulsions or even count them.

The Main Principles Of Why Do Banks Make So Much From Mortgages

" For HUD or anybody else to state that individuals dying and foreclosure is the natural end to a reverse home mortgage is absurd," Jolley said. "No consumer enters into one of these thinking, 'Eventually my house will enter into foreclosure.' All foreclosures are unneeded, and this boost indicates a failure of the program to deliver on its promise." Promised retirement stability through reverse mortgages, senior citizens now deal with foreclosureUrban African Americans are hardest hit as almost 100,000 loans have failed.

The principle was piloted by the Reagan administration and took off in popularity in the 2000s as a method for elders to "age in location." They work like this: Lenders evaluate the value of a house and allow homeowners to obtain back cash against that market price - why is there a tax on mortgages in florida?. Customers can stop making regular monthly home mortgage payments, and they can remain put for life, so long as they maintain the house and pay home taxes and insurance.

At the end a vacate, death or default the bank calls the loan due, to be paid back either by the sale of the house or an heir or property owner repaying the loan cash. Lenders and their financiers make their money through origination costs that can top $15,000 with costs and home loan insurance, and by charging interest on the loan balance.

The 6-Minute Rule for What Does It Mean When People Say They Have Muliple Mortgages On A House

Issues emerged in the wake of " full-draw" loans 8 in the late 2000s, when reverse home loan loan providers provided a swelling sum to a debtor. Sales got as Americans began struggling financially and residential or commercial property values deteriorated. Given that reverse home loans assume the home will continue to value, loan balances in some cases ballooned well past the marketplace worth of a post-recession home.

Leroy Roebuck's home was appraised at $112,000 in 2008. That allowed him to get as much as $83,000 in equity. By the time he was obtained for a second reverse home mortgage, an appraiser said it was worth $241,000, permitting him up to $163,000 more. He obtained $102,000 in all. The 104-year-old house near Temple University deserves far less today, about $165,000.

" We now try to find individuals that are comfortable in their retirement with a plan and resources to preserve their fundamental commitments however might utilize a little additional assistance for a specific need or quality of life." The scar reverse home loan https://www.insurancebusinessmag.com/us/news/breaking-news/timeshare-specialists-launch-into-insurance-233082.aspx failures leave on areas can be seen on a drive through Chicago's South Side with long time resident and community organizer Pat DeBonnett.

The Best Guide To Which Banks Are Best For Poor Credit Mortgages

Boarded up houses and empty parcels followed. DeBonnett mentions blocks in the Roseland location as "definitely devastated." Yale and 113th fits that description. In the 60628 POSTAL CODE, it is the epicenter of the reverse home loan foreclosure crisis, where more homes have been seized than anywhere else in the country.

What Can Mortgages Be Used For Things To Know Before You Buy

In a stealth aftershock of the Great Economic crisis, almost 100,000 loans that allowed elderly people to take advantage of their house equity have failed, blindsiding senior customers and their households and dragging down property worths in their areas. In many cases, the worst toll has fallen on those ill-equipped to shoulder it: urban African Americans, much of whom worked for most of their lives, then discovered themselves having a hard time in retirement.

U.S.A. TODAY's review of government foreclosure information discovered a generation of households fell through the fractures and continue to suffer from reverse home mortgage loans composed a decade ago. These senior homeowners were wooed into borrowing money through the special program by appealing sales pitches or a dire requirement for cash or both.

Those foreclosures erased hard-earned generational wealth integrated in the decades given that the Fair Real Estate Act of 1968 1. Leroy Roebuck, 86, rode the bus his whole profession to a nearby drape maker. When he needed to make home repairs, he relied on reverse home loans after seeing an ad on tv.

The 9-Minute Rule for What Happened To Cashcall Mortgage's No Closing Cost Mortgages

Including charges and charges, his loan servicer says he now owes more than $20,000. Roebuck's first foreclosure notification was available in the mail six years earlier, and he is still fighting to hold on to the brick walk-up he purchased from his moms and dads in 1970, living in it through a special health exemption to foreclosure.

Jasper Colt, U.S.A. TODAYLeroy Roebuck, of Philadelphia, who declared insolvency and is still dealing with foreclosure on his homeI told my boy, 'Never ever. They ain't gon na take this house.' I'll go to the deep blue sea, they're not going to take this house. Quote icon "I informed my kid, 'Never ever.

" I'll go to the deep blue sea, they're not going to take this home." Senior homeowners and their adult children told similar stories in big city areas across the USA.Borrowers living near the poverty line in pockets of Chicago, Baltimore, Miami, Detroit, Philadelphia and Jacksonville, Florida, are among the hardest struck, according to a first-of-its-kind analysis of more than 1.

How Do You Reserach Mortgages Records - Truths

U.S.A. TODAY worked in collaboration with Grand Valley State University, with support from the McGraw Center for Business Journalism. Consumer advocates said the analysis supports what they have actually grumbled about for several years that deceitful lenders targeted lower-income, black areas and motivated elderly house owners to borrow cash while glossing over the threats and requirements.

Even comparing only poorer areas, black communities fare even worse. In ZIP codes where most residents earn less than $40,000, the analysis found reverse home loan foreclosure rates were 6 times greater in black areas than in white ones. The foreclosure disparity looks like a more familiar circumstance from the late 2000s, when subprime lenders targeted specific neighborhoods with dangerous loans destined stop working, according to the country's lead reverse home mortgage scientist.

In numerous reverse home loan default cases reviewed by U.S.A. TODAY, the homeowners' initial monetary needs were basic, the sort of difficulties home repairs and medical expenses that those with much easier access to credit and more disposable earnings can weather with a second standard mortgage or home equity loan 2.

All About Who Issues Ptd's And Ptf's Mortgages

They went to where they knew people required cash and often strolled door-to-door, targeting homes with rotting roofs or dripping windows. Door hangers advertised a "tax-free" advantage for seniors.Cherelle Parker 3,a councilwoman on Philadelphia's north side, called reverse home loans a scourge on her neighborhood that has put unnecessary financial and psychological pressure on senior citizens.

" We've asked: Why was Philadelphia so targeted to get this loan product? ... America should take note." The broader public likewise pays a high rate. what beyoncé and these billionaires have in common: massive mortgages. Reverse mortgages are insured by a Federal Real estate Administration fund, which remains in the red more than $13. 6 billion because of an increase in claims paid out to reverse mortgage lenders because the recession.

The typical regard to a reverse mortgage has to do with 7 years, and if a relative is not willing or able to pay back the loan, lending institutions press the residential or commercial property through foreclosure. Regulators stated actual evictions of seniors are rare. There's no chance to validate that, though, considering that HUD, the leading federal government regulator of Home Equity Conversion Home Loan 4 loans, does not accept evictions and even count them.

Top Guidelines Of What Are Brea Loans In Mortgages

" For HUD or anyone else to state that individuals passing away and foreclosure is the natural end to a reverse mortgage is ridiculous," Jolley stated. "No consumer gets into among these thinking, 'Eventually my home will enter into foreclosure.' All foreclosures are unnecessary, and this increase shows a failure of the program to deliver on its promise." Promised retirement stability through reverse mortgages, seniors now deal with foreclosureUrban African Americans are hardest struck as almost 100,000 loans have stopped working.

The concept was piloted by the Reagan administration and blew up in popularity in the 2000s as a method for elders to "age in location." They work like this: Lenders evaluate the value of a home and permit house owners to obtain back cash versus that market price - how is the compounding period on most mortgages calculated. Customers can stop making month-to-month home mortgage payments, and they can sit tight for life, so long as they keep the home and pay property taxes and insurance coverage.

At the end a leave, death or default the bank calls the loan due, to be repaid either by the sale of the home or an heir or property owner paying back the loan money. Lenders and their financiers make their cash through origination fees that can top $15,000 with charges and mortgage insurance coverage, and by charging interest on the loan balance.

How Find Out How Many Mortgages Are On A Property can Save You Time, https://www.crunchbase.com/organization/wesley-financial-group Stress, and Money.

Problems emerged in the wake of " full-draw" loans 8 in the late 2000s, when reverse home loan lenders provided a lump amount to a borrower. Sales selected up as Americans began having a hard time economically and residential or commercial property worths worn down. Since reverse home mortgages presume the home will continue to value, loan balances sometimes swelled well past the market value of a post-recession home.

Leroy Roebuck's home was evaluated at $112,000 in 2008. That allowed him to get as much as $83,000 in equity. By the time he was obtained for a 2nd reverse mortgage, an appraiser said it deserved $241,000, allowing him approximately $163,000 more. He obtained $102,000 in all. The 104-year-old home near Temple University is worth far less today, about $165,000.

" We now look for people that are comfy in their retirement with a strategy and resources to preserve their standard commitments but could utilize a little additional aid for a particular need https://www.insurancebusinessmag.com/us/news/breaking-news/timeshare-specialists-launch-into-insurance-233082.aspx or quality of life." The scar reverse home mortgage failures leave on neighborhoods can be seen on a drive through Chicago's South Side with longtime homeowner and neighborhood organizer Pat DeBonnett.

Some Known Facts About Which Mortgages Have The Hifhest Right To Payment'.

Boarded up homes and empty parcels followed. DeBonnett mentions blocks in the Roseland area as "absolutely ravaged." Yale and 113th fits that description. In the 60628 POSTAL CODE, it is the center of the reverse home mortgage foreclosure crisis, where more homes have been taken than anywhere else in the country.

The What Is The Highest Interest Rate For Mortgages Statements

In a stealth aftershock of the Great Recession, nearly 100,000 loans that enabled seniors to use their house equity have stopped working, blindsiding senior borrowers and their families and dragging down property values in their neighborhoods. Oftentimes, the worst toll has fallen on those ill-equipped to carry it: urban African Americans, a lot of whom worked for the majority of their https://www.insurancebusinessmag.com/us/news/breaking-news/timeshare-specialists-launch-into-insurance-233082.aspx lives, then discovered themselves struggling in retirement.

U.S.A. TODAY's review of federal government foreclosure data discovered a generation of families fell through the fractures and continue to struggle with reverse mortgage written a years ago. These elderly homeowners were wooed into obtaining cash through the unique program by attractive sales pitches or an alarming requirement for cash or both.

Those foreclosures cleaned out hard-earned generational wealth integrated in the decades considering that the Fair Real Estate Act of 1968 1. Leroy Roebuck, 86, rode the bus his entire career to a close-by curtain producer. When he needed to make home repair work, he relied on reverse home mortgages after seeing an ad on tv.

The Basic Principles Of Which Mortgages Have The Hifhest Right To Payment'

Including costs and charges, his loan servicer states he now owes more than $20,000. Roebuck's first foreclosure notification can be found in the mail six years earlier, and he is still fighting to hang on to the brick walk-up he purchased from his moms and dads in 1970, residing in it through a special health exemption to foreclosure.

Jasper Colt, U.S.A. TODAYLeroy Roebuck, of Philadelphia, who filed for insolvency and is still facing foreclosure on his homeI informed my boy, 'Never ever. They ain't gon na take this home.' I'll go to the deep blue sea, they're not going to take this home. Quote icon "I told my boy, 'Never ever.

" I'll go to the deep blue sea, they're not going to take this house." Elderly property owners and their adult children told comparable stories in huge city neighborhoods across the USA.Borrowers living near the poverty line in pockets of Chicago, Baltimore, Miami, Detroit, Philadelphia and Jacksonville, Florida, are among the hardest hit, according to a first-of-its-kind analysis of more than 1.

What Does What Is The Interest Rate Today On Mortgages Do?

USA TODAY worked in partnership with Grand Valley State University, with support from the McGraw Center for Company Journalism. Consumer supporters said the analysis supports what they have actually complained about for years that deceitful lending institutions targeted lower-income, black neighborhoods and encouraged senior homeowners to obtain cash while glossing over the risks and requirements.

Even comparing only poorer areas, black neighborhoods fare worse. In POSTAL CODE where most locals earn less than $40,000, the analysis discovered reverse home loan foreclosure rates were 6 times greater in black areas than in white ones. The foreclosure disparity resembles a more familiar situation from the late 2000s, when subprime lenders targeted specific neighborhoods with dangerous loans destined fail, according to the country's lead reverse home mortgage researcher.

In numerous reverse home loan default cases evaluated by USA TODAY, the property owners' initial financial requirements were basic, the sort of difficulties house repairs and medical expenses that those with simpler access to credit and more non reusable earnings can weather with a second standard https://www.crunchbase.com/organization/wesley-financial-group home mortgage or house equity loan 2.

Unknown Facts About What Is Today's Interest Rate On Mortgages

They went to where they understood individuals needed cash and often strolled door-to-door, targeting homes with decomposing roofs or dripping windows. Door wall mounts advertised a "tax-free" benefit for seniors.Cherelle Parker 3,a councilwoman on Philadelphia's north side, called reverse home loans a scourge on her neighborhood that has actually put unneeded financial and emotional strain on senior citizens.

" We've asked: Why was Philadelphia so targeted to get this loan product? ... America needs to pay attention." The broader public also pays a steep rate. how to reverse mortgages work if your house burns. Reverse mortgages are insured by a Federal Real estate Administration fund, which is in the red more than $13. 6 billion due to the fact that of a boost in claims paid out to reverse home mortgage lenders because the economic crisis.

The average regard to a reverse home loan has to do with 7 years, and if a family member is not willing or able to repay the loan, loan providers press the property through foreclosure. Regulators said actual evictions of seniors are rare. There's no other way to confirm that, though, because HUD, the leading federal government regulator of Home Equity Conversion Home Loan 4 loans, does not sign off on expulsions or even count them.

Top Guidelines Of What Is The Deficit In Mortgages

" For HUD or anyone else to state that individuals dying and foreclosure is the natural end to a reverse mortgage is absurd," Jolley said. "No customer gets into among these thinking, 'Eventually my home will go into foreclosure.' All foreclosures are unnecessary, and this boost shows a failure of the program to deliver on its promise." Promised retirement stability through reverse home loans, senior citizens now deal with foreclosureUrban African Americans are hardest struck as nearly 100,000 loans have actually stopped working.

The idea was piloted by the Reagan administration and blew up in appeal in the 2000s as a way for elders to "age in location." They work like this: Lenders appraise the worth of a house and permit homeowners to obtain back money versus that market worth - what act loaned money to refinance mortgages. Customers can stop making regular monthly home loan payments, and they can sit tight for life, so long as they keep the house and pay residential or commercial property taxes and insurance.

At the end a leave, death or default the bank calls the loan due, to be paid back either by the sale of the home or a beneficiary or homeowner repaying the loan cash. Lenders and their investors make their money through origination charges that can top $15,000 with fees and mortgage insurance, and by charging interest on the loan balance.

The Single Strategy To Use For How Is Mortgages Priority Determined By Recording

Issues emerged in the wake of " full-draw" loans 8 in the late 2000s, when reverse mortgage loan providers issued a lump sum to a debtor. Sales picked up as Americans began struggling financially and residential or commercial property values eroded. Because reverse home loans presume the home will continue to value, loan balances in many cases ballooned well past the marketplace value of a post-recession house.

Leroy Roebuck's house was evaluated at $112,000 in 2008. That enabled him to take out up to $83,000 in equity. By the time he was obtained for a second reverse home loan, an appraiser said it deserved $241,000, enabling him up to $163,000 more. He obtained $102,000 in all. The 104-year-old house near Temple University deserves far less today, about $165,000.

" We now search for people that are comfortable in their retirement with a plan and resources to preserve their standard obligations however might use a little additional assistance for a specific requirement or lifestyle." The scar reverse home loan failures leave on communities can be seen on a drive through Chicago's South Side with longtime local and community organizer Pat DeBonnett.

How Many Mortgages Can You Have With Freddie Mac Can Be Fun For Anyone

Boarded up homes and empty parcels followed. DeBonnett points out blocks in the Roseland area as "definitely ravaged." Yale and 113th fits that description. In the 60628 POSTAL CODE, it is the center of the reverse home loan foreclosure crisis, where more homes have been taken than anywhere else in the country.

4 Simple Techniques For Which Of The Following Is Not A Guarantor Of Federally Insured Mortgages?

They have to select a compensation bundle with each lender they deal with ahead of time so all debtors are charged the same flat portion rate. Obviously, they can still partner with 3 various wholesale banks and choose differing settlement packages, then effort to send customers to the one that pays one of the most.

Sure, you may not pay any home mortgage points out-of-pocket, but you might pay the price by consenting to a greater mortgage rate than necessary, which equates to a lot more interest paid throughout the life of the loan assuming you keep it for a while. Some lenders might offer so-called negative points Which is another method of saying a loan provider credit These points raise your rate instead of decreasing it However lead to a credit that can cover closing costs If points are included and you are offered a higher rate, the mortgage points function as a lender credit toward your closing expenses - how do commercial mortgages work.

Now you might be questioning why on earth you would accept a higher rate than what you receive? Well, the compromise is that you don't need to spend for your closing expenses out-of-pocket. The cash produced from the greater interest rate will cover those fees. Of course, your regular monthly home loan payment will be higher as an outcome.

This operates in the exact opposite way as traditional mortgage points because you get a higher rate, however instead of spending for it, the lender provides you cash to pay for your charges. Both approaches can work for a debtor in an offered situation. The positive points are great for those looking to lower their home loan rate even more, whereas the negative points are good for a property owner brief on cash who doesn't desire to invest all of it at closing.

How Does Underwriting Work For Mortgages Fundamentals Explained

If the broker is being paid 2 mortgage points from the lending institution at par to the borrower, it will reveal up as a $2,000 origination charge (line 801) and a $2,000 credit (line 802) on the HUD-1 settlement statement. It is awash since you don't pay the points, the lending institution does.

Now let's presume you're just paying two mention of your own pocket to compensate the broker. It would just appear as a $2,000 origination charge, with no credit or charge for points, because the rate itself doesn't involve any points. You may also see nothing in the way of points and instead an administration cost or comparable slightly named charge.

It could represent Check out here a particular portion of the loan amount, but have absolutely nothing to do with raising or decreasing your rate. No matter the variety of mortgage points you're ultimately charged, you'll be able to see all the figures by evaluating the HUD-1 (lines 801-803), which information both loan origination costs and discount rate points and the overall expense combined.

Above is an useful little chart I made that displays the expense of home mortgage points for various loans quantities, varying from $100,000 to $1 million. As you can see, a home mortgage point is just equivalent to $1,000 at the $100,000 loan amount level. So you may be charged several points if you've got a smaller loan quantity (they require to make cash in some way).

What Does How Do Reverse Mortgages Really Work? Mean?

And you question why loan officers wish to stem the biggest loans possible Normally, it's the exact same quantity of work for a much larger payday if they can get their hands on the very jumbo loans out there. Be sure to compare the expense of the loan with and without mortgage points included, across different loan programs such as standard offerings and FHA loans.

Likewise note that not every bank and broker charges home loan points, so if you take the time to search, you might have the ability to avoid points totally while securing the lowest mortgage rate possible. Check out more: Are home loan points worth paying! (how reverse mortgages work).

?.!?. Editorial IndependenceWe wish to help you make more informed decisions. Some links on this page clearly marked might take you to a partner website and might lead to us making a recommendation commission. For more details, seeOne of the lots of financial results of COVID-19 is that rate of interest on mortgages have actually dropped to record low levelspresenting a money-saving chance for those fortunate adequate to be in a position to buy or refinance a house.

However there's another method to get a lower interest ratefor a rate. Purchasing mortgage points, also understood as "purchasing down the rate," is a strategy that includes paying additional money upfront at closing in order to shave down the rates of interest of your loan. Generally, buying home loan points is just worth your while if you prepare to stay in your home for numerous years, usually a minimum of 6.

Canada How Do. Mortgages Work 5 Years for Dummies

Would you rather invest that cash upfront to purchase down your rate, or does it make more sense to put down a larger down paymentor even sock that money away into your 401( k) account? Here are the things to consider when examining home mortgage points. Lenders deal mortgage points, likewise referred to as discount rate points, when you look for a home mortgage.

Lenders likewise describe mortgage points as "buying down the rate." Choosing to take points on a home mortgage is totally optional, however it is one method to reduce your overall rates of interest and your regular monthly payment. Most loan providers let Informative post you buy between one and three points (often less, in some cases more) which you pay upfront as part of your closing costs.

The monthly savings that result will depend upon the interest rate, how much you borrow, and the term of the loan. The length of time you plan to be in the house is important to your estimations. It normally takes a borrower in between 4-6 years to recoup the expense from paying discount rate points at closing, states David Reischer, a property lawyer at LegalAdvice.

Remember home loan points are typically just used for fixed-rate loans. They are offered for adjustable-rate home loans (ARMs), but they just reduce your rate for your introductory period up until the rate changes, which does not make the investment worth it. The table below will show you simply just how much points cost, how much you can conserve, the discount rate you might see on your rate, and for how long it requires to recover cost using the example of a 30-year, 3 - how does underwriting work for mortgages.

Not known Factual Statements About How Do Bad Credit Mortgages Work

PointsAPR (Before discount) APR (with 0. 25% discount rate per point) Points Cost (1 point= 1% of loan) Regular monthly Payment (principal plus interest) Cost savings Per MonthBreak Even Variety https://gumroad.com/pethernmbm/p/the-buzz-on-how-do-adjustable-rate-mortgages-work of Months0 points3. 53%$ 0$ 1,126$ 01 Point3. 53% 3. 28%$ 2,500$ 1,092$ 34 73. 5 2 Points3. 53% 3. 03%$ 5,000$ 1,058$ 6873. 5 3 points3. 53% 2. 78%$ 7,500$ 1,024$ 10273. 5 * Rates above based on June 2020 rates As you can see, investing $5,000 upfront to buy down two points will reduce your rate from 3.

03%, conserving you $68 on regular monthly home mortgage payments. As soon as your $5,000 is paid back after about six years, you will start to see savings. In this example, a savings of $68 each month can turn into $816 conserved each year, and $8,160 conserved on your loan over the following ten years.

Some Known Facts About What The Interest Rate On Mortgages Today.

They need to pick a compensation plan with each lending institution they work with ahead of time so all borrowers are charged the very same flat percentage rate. Obviously, they can still partner with three various wholesale banks and choose varying payment plans, then effort to send customers to the one that pays the most.

Sure, you might not pay any mortgage points out-of-pocket, however you may pay the price by accepting a https://gumroad.com/pethernmbm/p/the-buzz-on-how-do-adjustable-rate-mortgages-work greater home loan rate than required, which equates to a lot more interest paid throughout the life of the loan assuming you keep it for a while. Some lenders may offer so-called negative points Which is another way of saying a loan provider credit These points raise your rate instead of lowering it But lead to a credit that can cover closing costs If points are involved and you are offered a higher rate, the mortgage points act as a loan provider credit towards your closing costs - how do muslim mortgages work.

Now you might be questioning why in the world you would accept a higher rate than what you receive? Well, the trade-off is that you don't have to pay for your closing expenses out-of-pocket. The cash created from the higher interest rate will cover those costs. Obviously, your month-to-month mortgage payment will be greater as an outcome.

This works in the specific opposite way as standard home mortgage points in that you get a greater rate, but rather of paying for it, the loan provider offers you money to pay for your charges. Both approaches can work for a customer in a given situation. The positive points benefit those wanting to decrease their home mortgage rate even more, whereas the unfavorable points benefit a property owner brief on money who does not desire to invest all of it at closing.

How Do Mortgages Work In Monopoly Fundamentals Explained

If the broker is being paid two home loan points from the lending institution at par to the customer, it will reveal up as a $2,000 origination charge (line 801) and a $2,000 credit (line 802) on the HUD-1 settlement statement. It is awash because you don't pay the points, the loan provider does.

Now let's presume you're just paying 2 explain of your own pocket to compensate the broker. It would simply reveal up as a $2,000 origination charge, without any credit or Check out here charge for points, because the rate itself doesn't include any points. You may also see nothing in the way of points and instead an administration charge or comparable slightly named charge.

It might represent a certain percentage of the loan quantity, but have nothing to do with raising or lowering your rate. Despite the variety of mortgage points you're ultimately charged, you'll be able to see all the figures by reviewing the HUD-1 (lines 801-803), which information both loan origination fees and discount points and the overall expense combined.

Above is a handy little chart I made that shows the cost of home loan points for various loans amounts, ranging from $100,000 to $1 million. As you can see, a mortgage point is just equivalent to $1,000 at the $100,000 loan amount level. So you may Informative post be charged a number of points if you've got a smaller loan quantity (they require to generate income somehow).

The Facts About How Do First And Second Mortgages Work Uncovered

And you question why loan officers wish to come from the biggest loans possible Normally, it's the exact same amount of work for a much bigger payday if they can get their hands on the super jumbo loans out there. Make sure to compare the expense of the loan with and without home loan points consisted of, throughout various loan programs such as conventional offerings and FHA loans.

Also note that not every bank and broker charges home mortgage points, so if you make the effort to look around, you might have the ability to avoid points entirely while securing the most affordable mortgage rate possible. Read more: Are home mortgage points worth paying! (how do adjustable rate mortgages work).

?.!?. Editorial IndependenceWe want to help you make more educated choices. Some links on this page plainly marked may take you to a partner site and might result in us earning a referral commission. To learn more, seeOne of the numerous economic impacts of COVID-19 is that interest rates on home mortgages have actually dropped to tape-record low levelspresenting a money-saving chance for those lucky sufficient to be in a position to buy or refinance a house.

However there's another way to get a lower interest ratefor a cost. Getting mortgage points, also referred to as "buying down the rate," is a strategy that involves paying additional money upfront at closing in order to shave down the rates of interest of your loan. Normally, buying mortgage points is only worth your while if you plan to remain in your house for several years, typically a minimum of 6.

Not known Details About How Do Mortgages Work?

Would you rather invest that money upfront to buy down your rate, or does it make more sense to put down a larger down paymentor even sock that money away into your 401( k) account? Here are the things to consider when evaluating mortgage points. Lenders deal home mortgage points, likewise referred to as discount points, when you make an application for a home loan.

Lenders also describe home mortgage points as "purchasing down the rate." Picking to take points on a home loan is entirely optional, but it is one way to reduce your total rates of interest and your regular monthly payment. Most lenders let you acquire in between one and 3 points (sometimes less, in some cases more) which you pay in advance as part of your closing costs.

The month-to-month savings that result will depend upon the rate of interest, how much you borrow, and the regard to the loan. The length of time you plan to be in the home is important to your computations. It normally takes a borrower in between 4-6 years to recover the cost from paying discount points at closing, states David Reischer, a realty lawyer at LegalAdvice.

Remember mortgage points are usually only utilized for fixed-rate loans. They are available for variable-rate mortgages (ARMs), however they just decrease your rate for your initial duration till the rate changes, which does not make the investment worth it. The table below will reveal you just just how much points cost, how much you can save, the discount you could see on your rate, and for how long it takes to recover cost using the example of a 30-year, 3 - how do construction mortgages work.

Top Guidelines Of Reddit How Finances And Mortgages Work

PointsAPR (Before discount rate) APR (with 0. 25% discount per point) Points Cost (1 point= 1% of loan) Regular monthly Payment (principal plus interest) Savings Per MonthBreak Even Variety of Months0 points3. 53%$ 0$ 1,126$ 01 Point3. 53% 3. 28%$ 2,500$ 1,092$ 34 73. 5 2 Points3. 53% 3. 03%$ 5,000$ 1,058$ 6873. 5 3 points3. 53% 2. 78%$ 7,500$ 1,024$ 10273. 5 * Rates above based upon June 2020 rates As you can see, investing $5,000 upfront to buy down two points will decrease your rate from 3.

03%, conserving you $68 on month-to-month home mortgage payments. Once your $5,000 is repaid after about six years, you will start to see cost savings. In this example, a savings of $68 each month can turn into $816 saved per year, and $8,160 minimized your loan over the following 10 years.

How Do Down Payments Work On Mortgages for Beginners

They need to select a payment bundle with each lending institution they deal with beforehand so all customers are charged the very same flat portion rate. Obviously, they can still partner with 3 various wholesale banks and select varying settlement bundles, then effort to Check out here send customers to the one that pays one of the most.

Sure, you may not pay any mortgage points out-of-pocket, but you might pay the cost by concurring to a higher home loan rate than essential, Informative post which corresponds to a lot more interest paid throughout the life of the loan presuming you keep it for a while. Some loan providers may offer so-called negative points Which is another method of saying a lending institution credit These points raise your rate instead of decreasing it But lead to a credit that can cover closing expenses If points are included and you are used a higher rate, the home loan points serve as a lending institution credit towards your closing expenses - how do reverse mortgages work.

Now you might be wondering why in the world you would accept a higher rate than what you qualify for? Well, the compromise is that you don't need to pay for your closing expenses out-of-pocket. The cash generated from the greater rates of interest will cover those charges. Of course, your monthly mortgage payment will be greater as an outcome.

This operates in the specific opposite way as standard home mortgage points because you get a greater rate, but instead of spending for it, the lender offers you cash to pay for your costs. Both approaches can work for a borrower in an offered circumstance. The positive points benefit those wanting to decrease their home loan rate much more, whereas the negative points are excellent for a property owner short on money who doesn't want to invest all of it at closing.

The How Do Commercial Real Estate Mortgages Work Statements

If the broker is being paid 2 home loan points from the lender at par to the borrower, it will show up as a $2,000 origination charge (line 801) and a $2,000 credit (line 802) on the HUD-1 settlement declaration. It is awash because you don't pay the points, the lender does.

Now let's presume you're simply paying two points out of your own pocket to compensate the broker. It would merely reveal up as a $2,000 origination charge, without any credit or charge for points, given that the rate itself does not involve any points. You may also see nothing in the way of points and instead an administration charge or similar vaguely named charge.

It might represent a certain percentage of the loan amount, but have nothing to do with raising or decreasing your rate. Regardless of the variety of home mortgage points you're ultimately charged, you'll be able to see all the figures by examining the HUD-1 (lines 801-803), which information both loan origination charges and discount rate points and the overall cost integrated.

Above is a handy little chart I made that shows the cost of home loan points for different loans quantities, varying from $100,000 to $1 million. As you can see, a home loan point is only equivalent to $1,000 at the $100,000 loan amount level. So you may be charged several points if you have actually got a smaller loan amount (they need to make cash somehow).

The Main Principles Of How Do Uk Mortgages Work

And you wonder why loan officers wish to originate the largest loans possible Typically, it's the same amount of work for a much larger payday if they can get their hands on the incredibly jumbo loans out there. Make sure to compare the cost of the loan with and without mortgage points consisted of, across various loan programs such as standard offerings and FHA loans.

Likewise note that not every bank and broker charges home mortgage points, so if you make the effort to search, you may be able to avoid points entirely while securing the most affordable mortgage rate possible. Find out more: Are home mortgage points worth paying! (how reverse mortgages work).

?.!?. Editorial IndependenceWe wish to assist you make more informed decisions. Some links on this page clearly marked might take you to a partner website and may lead to us making a recommendation commission. For more details, seeOne of the lots of financial impacts of COVID-19 is that rates of interest on mortgages have actually dropped to record low levelspresenting a money-saving opportunity for those lucky enough to be in a position to purchase or refinance a home.

However there's another method to get a lower interest ratefor a cost. Buying mortgage points, also called "purchasing down the rate," is a method that involves paying extra cash upfront at closing in order to shave down the rate of interest of your loan. Typically, purchasing home loan points is only worth your while if you plan to remain in your house for several years, generally at least 6.

How How Do Reverse Mortgages Work When You Die can Save You Time, Stress, and Money.

Would you rather invest that money upfront to purchase down your rate, or does it make more sense to put down a larger down paymentor even sock that money away into your 401( k) account? Here are the things to think about when evaluating mortgage points. Lenders deal home mortgage points, likewise referred to as discount points, when you use for a mortgage.

Lenders also refer to home loan points as "purchasing down the rate." Picking to take points on a home loan is completely optional, but it is one method to reduce your general rates of interest and your regular monthly payment. A lot of lending institutions let you acquire between one and 3 points (sometimes less, often more) which you pay in advance as part of your closing expenses.